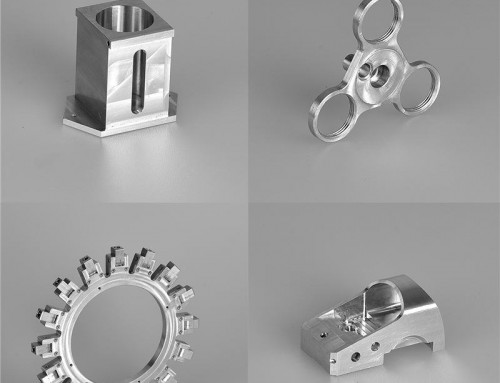

The total size of the global robot market was 13.1 billion U.S. dollars, up 18% over the same period of last year. If you include software, peripheral products and systems engineering, the total size of 40%.

Robot shipments in the electronics and automotive sectors are almost identical, and the latter has been driving the robotics industry since 1970. As robot sizes shrink, prices fall, and accuracy increases, so do robot needs in the battery, chip and display areas.

Sales in the electrical and electronics sectors increased 41% to 91,300 units. The automotive industry increased by 6% to 103,300 units, accounting for 35% of the 294,312 units sold by the industry.

IFR expects global robot capacity to grow at least 18% this year and at least 15% annually by 2018 to 2020.

IFR said the impetus for future demand will be to connect the reality plant’s industrial internet with virtual reality, collaborative robots that work side by side with humans, and machine learning and artificial intelligence.

China ranked first in the world with 30% of its sales volume and 27% of its shipments.

South Korea, the second largest in size, increased 8%. South Korea has 2145 robots per 10,000 manufacturing workers and its robot density has almost doubled since 2009, the highest in the world.

Japan last year’s robot sales increased 10%. US robot installation increased by 14%. IFR said U.S. growth continues to benefit from the localization of manufacturing. Robot shipments in Germany basically stagnated.